The Comprehensive Guide to the Advantages and Utilizes of an Offshore Trust Wide Range Administration

Comprehending Offshore Counts On: What They Are and Exactly how They Function

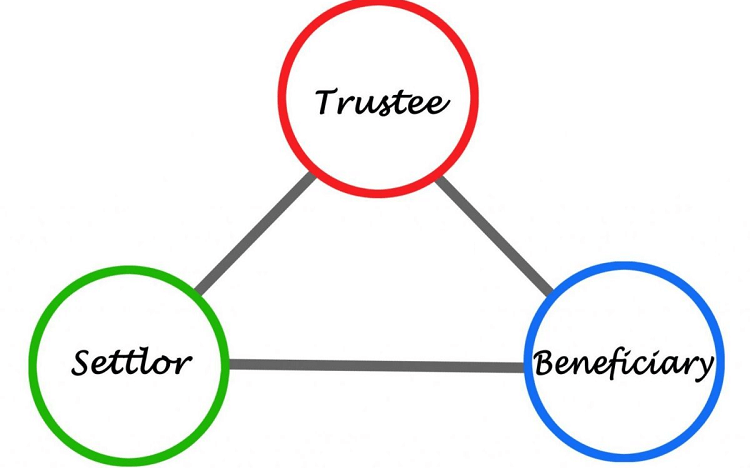

Offshore counts on are effective economic tools that can aid safeguard your assets and give tax benefits. Basically, an offshore Trust is a lawful plan where you transfer your properties to a trust located outside your home nation. By doing this, you effectively separate ownership from control, permitting a trustee to manage the assets in your place. This plan can protect your riches from financial institutions, suits, or political instability.When establishing an overseas Trust, you'll select a jurisdiction known for its favorable regulations and guidelines. This can offer you greater privacy and adaptability in managing your investments. You'll likewise require to designate a dependable trustee, that will certainly be liable for administering the Trust according to your instructions. Understanding exactly how overseas depends on work can encourage you to make educated decisions about your wide range administration technique and improve your financial safety and security.

Trick Advantages of Establishing an Offshore Trust

Developing an offshore Trust can supply you a number of considerable benefits that enhance your wide range monitoring technique. Initially, these depends on provide flexibility in exactly how you take care of and distribute your properties. You can customize the Trust terms to meet your particular monetary objectives and family members needs, guaranteeing your wealth is taken care of according to your wishes.Additionally, offshore depends on typically feature desirable tax obligation benefits. You might be able to postpone tax obligations or even decrease your general tax obligation, relying on the territory. This can lead to better wealth build-up over time.Moreover, an overseas Trust can improve your estate planning. It allows you to successfully move wealth to your successors, potentially reducing estate taxes and preventing probate.Finally, having an offshore Trust can improve your economic personal privacy, maintaining your assets and economic affairs confidential from public analysis. These advantages make overseas depends on a powerful tool in your wealth administration arsenal.

Possession Defense: Securing Your Wealth From Lenders

Among one of the most compelling reasons to consider an offshore Trust is its capacity to provide robust possession protection against lenders (offshore trust). By putting your possessions in an offshore Trust, you produce a lawful obstacle between your wide range and prospective insurance claims from financial institutions. This can be especially helpful if you're facing litigation or expect economic difficulties.When you establish an offshore Trust, your possessions are kept in a territory with stringent privacy legislations and safety guidelines. This makes it testing for financial institutions to access your wide range, offering you assurance. Additionally, the Trust framework frequently requires a third event to manage the assets, even more distancing your individual control and possession from possible lawful actions.Ultimately, with an offshore Trust, you can protect your riches from unanticipated scenarios, making certain that your possessions stay protected for your beneficiaries. It's a proactive action in preserving your economic future

Tax Obligation Efficiency: Leveraging Positive Jurisdictions

When you take into consideration offshore trust funds, leveraging favorable jurisdictions can considerably boost your tax obligation effectiveness. These areas frequently use beneficial tax obligation regulations that not only safeguard your assets yet likewise minimize estate tax obligations. By tactically placing your Trust the right location, you can enhance your wealth monitoring technique.

Favorable Tax Obligation Laws

By leveraging favorable tax obligation guidelines in offshore jurisdictions, you can substantially enhance your wide range administration approach. These jurisdictions commonly supply reduced or absolutely no tax rates on revenue, capital gains, and inheritances, permitting you to retain more of your wealth. Making use of an offshore Trust, you can gain from tax deferment, which suggests your financial investments can expand without prompt tax. This buildup can lead to significant long-lasting gains. In addition, numerous overseas counts on supply adaptable structures that can adapt to your altering monetary objectives, ensuring you stay tax-efficient. By purposefully placing your possessions in these beneficial settings, you're not just protecting your riches; you're also maximizing it for future development. Accept these tax advantages to maximize your economic potential.

Property Protection Advantages

Leveraging favorable territories not only enhances tax obligation efficiency however additionally offers robust asset protection benefits. By placing your properties in an overseas Trust, you protect them from prospective lawful cases, creditor actions, and financial instability in your home country. This tactical relocation allows you to safeguard your wealth from suits and unpredicted financial declines. Additionally, numerous offshore jurisdictions have stringent privacy laws, which can even more safeguard your assets from prying eyes. You'll obtain comfort recognizing your financial investments are safe, enabling you to focus on growth rather than concern. Ultimately, an offshore Trust acts as a solid obstacle against risks, ensuring your hard-earned wealth continues to be intact for future generations.

Inheritance Tax Minimization

While lots of people concentrate on prompt advantages, developing an offshore Trust can likewise considerably minimize estate tax obligations, making it try here a clever technique for maintaining riches. By leveraging desirable territories with reduced tax obligation prices or no inheritance tax in any way, you can markedly reduce the tax obligation burden on your beneficiaries. This means even more of your hard-earned properties can be given without being lessened by large tax obligations. In addition, an overseas Trust helps you maintain control over exactly how and when your properties are distributed, guaranteeing your family members's monetary future is safe. By strategically positioning your possessions within an overseas Trust, you're not simply shielding them; you're also enhancing tax efficiency, enabling you to optimize your wide range over generations.

Estate Planning: Making Sure Smooth Wide Range Transfer

Estate preparation is necessary for anybody seeking to ensure a smooth transfer of wide range to future generations. By establishing an offshore Trust, you can efficiently manage your possessions and ascertain they're distributed according to your desires. This aggressive approach enables you to outline details directions for your recipients, reducing the capacity for conflicts and complication down YOURURL.com the line. offshore trust.Incorporating an overseas Trust right into your estate plan can also provide flexibility. You can assign trustees that will take care of the Trust according to your guidelines, making sure that your wide range is dealt with responsibly. Additionally, utilizing an redirected here overseas Trust can aid you browse complicated tax obligation guidelines, eventually preserving even more of your estate for your beneficiaries

Privacy and Privacy: Keeping Your Finance Discreet

When you set up an overseas Trust, you acquire an effective means to keep your economic events private and personal. This framework allows you to separate your possessions from your personal name, making it harder for anybody to map your riches. Lots of offshore territories have stringent personal privacy legislations, which can protect your economic info from public scrutiny.Using an overseas Trust means you do not have to reveal your assets throughout legal process or monetary audits in your home nation. This level of discernment can be specifically valuable if you're worried concerning possible suits, divorce settlements, or creditor claims.Additionally, the Trust can help preserve confidentiality pertaining to beneficiaries, guaranteeing that your liked ones' economic scenarios stay discreet. By utilizing an overseas Trust, you can protect your monetary tradition while maintaining your events under covers, allowing you to focus on development instead of stressing concerning spying eyes.

Picking the Right Territory for Your Offshore Trust

When picking the right jurisdiction for your offshore Trust, you'll intend to think about both tax obligation benefits and asset security factors. Different locations use differing advantages, so it's vital to align your choice with your monetary goals. Comprehending these components can aid you protect your wealth successfully.

Tax Benefits Considerations

Selecting the right jurisdiction for your overseas Trust is necessary, as it can significantly impact the tax advantages you get. Different nations have differed tax regulations, and some deal tax incentives that can greatly reduce your responsibility. Jurisdictions with no capital gains tax obligation or inheritance tax obligation can provide considerable savings. It's vital to research and comprehend the tax obligation treaties between your home nation and the territory you're considering, as these can influence just how your Trust's income is taxed. Furthermore, search for territories that preserve privacy and supply a secure lawful structure. By carefully choosing a favorable territory, you can optimize the tax obligation advantages of your overseas Trust and safeguard your wealth much more efficiently.

Asset Protection Variables

While picking the ideal jurisdiction for your offshore Trust, it's crucial to consider exactly how well it can secure your assets from prospective lawful claims or creditors. Try to find territories with strong property protection legislations that deter financial institutions from accessing your Trust. Think about factors like the legal structure, stability, and credibility of the territory - offshore trust. Some areas supply "spender" stipulations that prevent recipients from squandering their inheritances. Additionally, take a look at the local laws regarding international counts on and tax obligation effects to guarantee conformity. By choosing a desirable jurisdiction, you can boost the safety of your wealth, decreasing dangers while taking full advantage of possible benefits. Eventually, the best selection can secure your possessions for you and your beneficiaries for generations

Frequently Asked Inquiries

Can an Offshore Trust Be Utilized for Charitable Objectives?

Yes, you can make use of an offshore Trust for philanthropic objectives. It permits you to support causes you respect while potentially gaining from tax advantages and securing your assets. It's a calculated way to repay.

What Are the Expenses Related To Establishing an Offshore Trust?

Setting up an offshore Trust involves numerous costs, consisting of lawful fees, setup fees, and ongoing maintenance costs. You'll require to spending plan for these aspects to assure your Trust operates efficiently and meets your economic objectives.

Exactly how Do I Maintain Control Over My Offshore Trust Possessions?

To preserve control over your offshore Trust assets, you can assign yourself as a protector or trustee, ensuring you choose. Frequently review Trust files and interact with your advisors to adjust to any type of adjustments.

Are There Risks Entailed in Developing an Offshore Trust?

Yes, there are threats in establishing an offshore Trust. You could deal with lawful complexities, potential tax obligation implications, and governing examination. It's important to seek advice from with specialists to navigate these challenges and protect your interests.

Can I Transfer My Existing Properties Into an Offshore Trust?

Yes, you can transfer your existing properties right into an offshore Trust. It's vital to seek advice from with economic and legal experts to guarantee conformity with guidelines and to understand the effects of such a transfer. Fundamentally, an overseas Trust is a legal arrangement where you move your properties to a count on situated outside your home country. You can tailor the Trust terms to meet your particular economic goals and family members needs, guaranteeing your wealth is taken care of according to your wishes.Additionally, overseas depends on commonly come with beneficial tax advantages. It enables you to effectively move wealth to your successors, potentially minimizing estate tax obligations and avoiding probate.Finally, having an offshore Trust can boost your monetary privacy, keeping your properties and monetary affairs personal from public analysis. Furthermore, the Trust structure commonly calls for a third party to take care of the assets, even more distancing your personal control and ownership from prospective legal actions.Ultimately, with an offshore Trust, you can guard your wide range from unforeseen situations, making sure that your possessions continue to be safe and secure for your recipients. Numerous offshore territories have rigorous privacy legislations, which can shield your financial info from public scrutiny.Using an offshore Trust implies you don't have to divulge your possessions during lawful proceedings or economic audits in your home nation.

Comments on “Offshore Trust for Entrepreneurs – Preserve Your Corporate Wealth”